Here’s the problem:

Everyone wants more money, but what is money? We treat its value like it is some sort of weird element found in the periodic table.

It has no taste, no sound, it is literally invisible but each and everyone of us simply trusts, follows, and praise it. We as humans are not fond in thinking critically about its real nature.

To make myself clear and lay out the problem for you, if you want to understand about markets and finance, it is crucial for you to know that you’re playing money’s game. And believe me, you have to know your opponent, otherwise it would be like playing poker blindfolded. It simply isn’t worth it.

Let me guide you through what I believe to be my thought process when someone (this NEVER happened) asks me what I think money to be:

First of all, money isn’t sacred. Money is a man made tool, with an intrinsic value of a piece of paper but the extrinsic value completely unchained from it. It could actually be represented as a technology, someone put some thought into it, but it really doesn’t do much.

So, what gives money power?

By breaking it down historically, logically, and economically:

- Barter: inefficient, no coincidence of wants.

- Commodity Money: gold, silver, platinum, grain, salt… this is actually something tangible, with an intrinsic value.

- Paper Money: printed by banks, backed by THE commodity (gold), but only for a while. After 1971, paper money became…

- Fiat Money: decreed by governments in accordance with central bank. Backed by… well, trust. Someone – not me I swear – said that a coin of approximately this size, with this iconography of Europe actually was worth 1 Euro. And we all trusted that guy.

- Digital Money: the “format” of fiat money when it is deposited into a bank account. Ones and zeroes on a database.

- Cryptocurrency: the scarcity is programmable, so the actual fair value computation of a coin is somewhat straightforward. The main difference is that here, trust is to be earned and not implicit. Decentralization is the key to discern what is to be trusted and what isn’t.

The conclusion I can draw is that money is actually a medium of exchange, nothing more, nothing less. If something can be used in exchange of something else, is a unit of account, and stores value, that is money. If trust collapses, the currency does too, and with it the banks, governments, and after 100 years of atomic warfare we would find ourselves wandering around selling soda caps like in Fallout. Money is the pillar of our society – and by automatism, capitalism is too – and we can’t do much about it.

Remember when I said that in 1971 paper money became fiat money? Well, picture this:

It is the 15th of August, 1971 and President Nixon announced something called “Nixon Shock”. What’s that? Uh, I see the tension rising. I’ll hit you with another thing: Nixon’s Shock ended the Bretton Woods System.

What? Too many things. Let’s break them down.

There’s a small city in New Hampshire called Bretton Woods, where in 1944 was held the United Nations Monetary and Financial Conference. Delegates from 44 Allied countries were tasked on finding a way to create a stable economy after WWII, and the conclusion they reached, was to have a fixed tender – the reserve currency – and fixed exchange rates, with that tender as the basis. The reserve currency, deemed to be the U.S. Dollar, was convertible at a $35 per ounce rate with gold, making it effectively and without any reasonable doubt backed by that commodity. Dollar was “as good as gold”. Furthermore, the IMF (International Monetary Fund), and the IBRD (International Bank for Reconstruction and Development) were born in Bretton Woods.

This system helped the post-war markets stability, opened the possibility of creating flexible economic policies, and lastly, set the pinpoint on the map for U.S. to be the economically dominant country in the world. Everything was based on the U.S. Dollar, given that U.S. was also the holder of two thirds of the worldwide’s gold reserve.

Nixon revolutionized this. We need to thank him for the floating exchange rates, so basically the classic Instagram guru you see trading with currency pairs (FOREX trading) wouldn’t exist without him.

As we will see in the next posts, this major move made it possible for our friend inflation to surge ($1 in 1971 ≈ $7.90 in 2025; This is a 690% increase, based on the average of 3.9% increase in inflation).

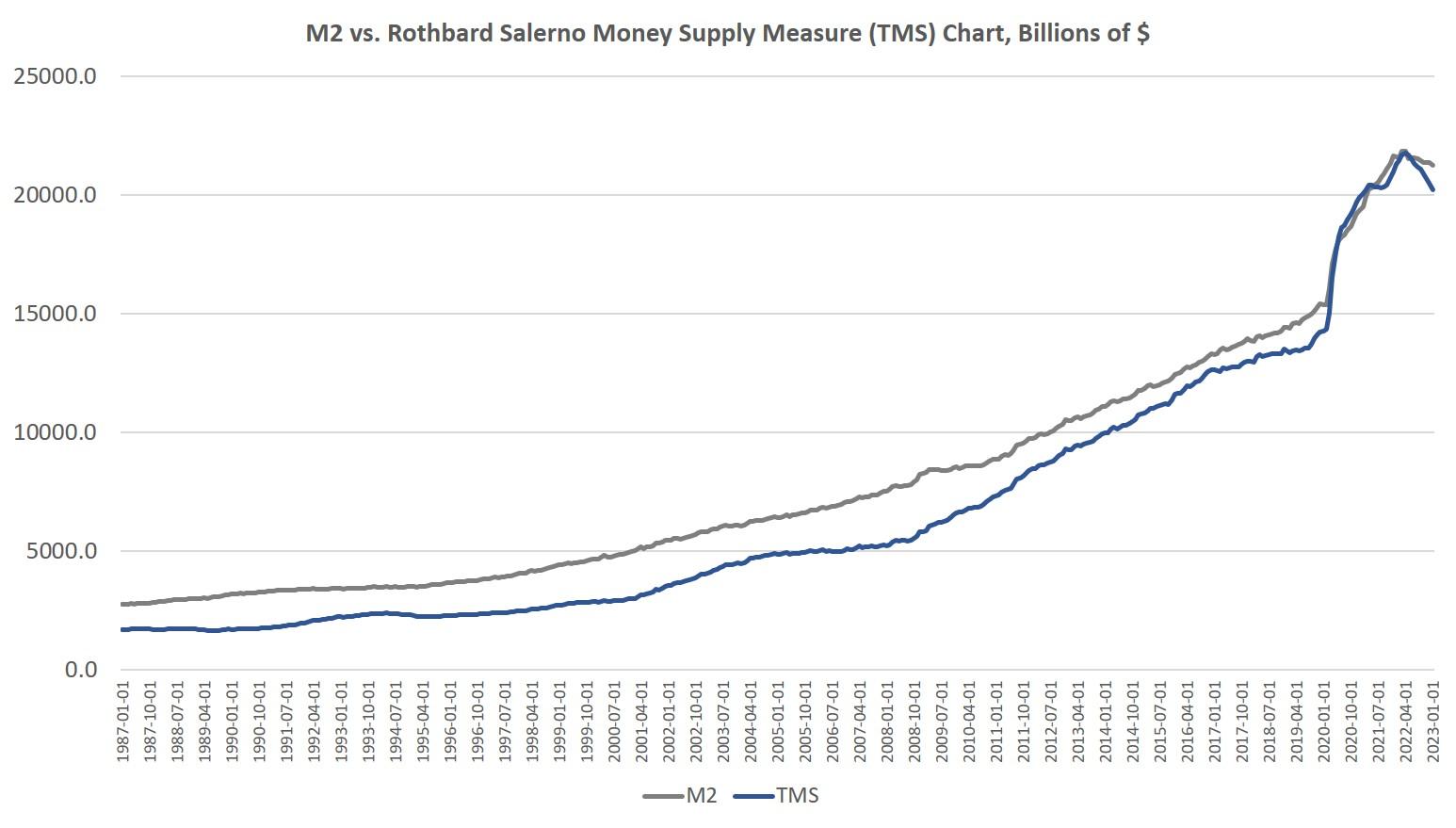

Wanna know the best thing? Over 50% of current U.S. Dollars in circulation was printed in the last 5 years:

I stopped viewing money as wealth. To me, wealth – Computational Economics Professor, if you’re reading this, please don’t hate me – is time + possibility of choice.

If you know me though, you know that my studies and my interest don’t go really along with cryptocurrencies. This is not because I hate progress – you’re reading this post in my blog which includes some things that I bet you haven’t seen anywhere else – but because I simply don’t want to get involved in pointless discussion with someone saying “you don’t understand anything, because CryptoMaster2348 on Reddit said that Bitcoin’s valuation will go at least to $1mln“.

Money is just branded truth. Take away the illusion, and you’ll get the real deal.

Leave a Reply