Table of Contents

The Hidden Thief: What Inflation Really Is.

The Textbook Definition is Useless.

The definition of inflation is “a general increase in the average price level of goods and services in an economy over time, which results in a decrease in the purchasing power of money“. Yes, this is literally the definition from Wikipedia.

To a reader who isn’t really a domain expert, I can understand how this could seem not intuitive, but let me clear out these thoughts.

You will have the chance to understand better the definition in the next subchapter.

I already hear you – “but there needs to be an indicator of how much inflation is at a given time” – yes, there is.

This indicator is called CPI or Consumer Price Index, and it tracks the average change over time of prices (prices paid by consumers for a representative basket of goods). Basically, it shows the evolution of the cost of living.

– If you actually incur the cost specified by the basket of goods, hit me up because I would really like to know a billionaire –

Can I suggest a question that you should’ve already asked?

“I heard people differentiate between monetary and price inflation, why?“

Thanks! That’s actually a nice question, and it’s useful to understand better the game in which we are a part. Monetary Inflation is the increase in the money supply within an economy, for example, you may have heard “The FED adopted another monetary policy, increasing the amount of produced M2 Currency“. This simply means that the FED is going to print more money. That’s it.

Price Inflation is the real deal, and the name of the thing I will describe in the following subchapter.

The Real-Life Feeling of Getting Poorer.

Simply put, you can see what (price) inflation is by just logically trying to answer some questions:

- Why do you feel like prices are rising? Is it because your cash flow decreased, or is it because the same things you used to buy cannot be bought for the same amount of money?

- But, actually, why does that thing cost more?

Let’s try with a simple, close-to-us example.

Milk:

- In 2010, a farmer used to earn €0.35-€0.40 for a liter of produced milk, and sold at a retail price of about €1 (this is pure inference, as I couldn’t find a reliable figure.)

- In 2025, a farmer now typically gains ~€0.51 per liter, while consumers pay the same liter at the supermarket in a range between €1.50-€2.20.

- You didn’t earn less; rather, you earned the same, without adjusting for inflation.

In Italy, in the same period, inflation rose between 1.6% and 1.9% annually. By performing a quick calculation, using the Compound Inflation Formula (which is itself a simple matter of calculating compound interest):

Where r = 0.0175 (1.75%, averaged), and n = 15 (timespan). So then we have:

Which results in ~1.29722. But this doesn’t actually tell us anything, does it? If we then subtract 1 and multiply by 100, we can find the exact percentage of how much the prices increased, 29.72%.

Following this logic:

Resulting in ~€0.48 per liter, which is roughly the figure we saw earlier (obviously due to major and minor fluctuations, the price differs).

But what did we find out?

We found out that there is an intrinsic increase in prices. To answer the “why is there this increase?” question, we can state several factors, including improved quality, higher investments, and technology, but the thing that interests us in this case is the fact that milk prices rose inherently because input costs rose. This creates a spiral:

Cost of food for cows is higher > The Farmer charges more because he incurs higher prices > The Supply chain has higher sunk costs > Logistics companies charge more to the farmer > The milk price is higher.

You can apply the same reasoning and principle to anything.

Why the System is Designed to Inflate.

According to economic theory, inflation is intrinsic in every economic system. This is mainly due to how the systems are set up.

I mean, if there is an arbitrary setting of a value somewhere, at some time, it is logical that one arbitrary thing cannot exist in the very middle of a chaotic and semi-random environment. The persistence of inflation is created not only by monetary policies, but also because of the system itself. It is required like a vaccine to avoid getting the plague.

I could go deep in the explanation of the magnitude of the impact on inflation given by elasticity of supply and demand, but that would be tedious, and quite sincerely, boring.

Why Holding Cash is a Self-Harming Practice.

The Silent Tax You’ve Never Voted For.

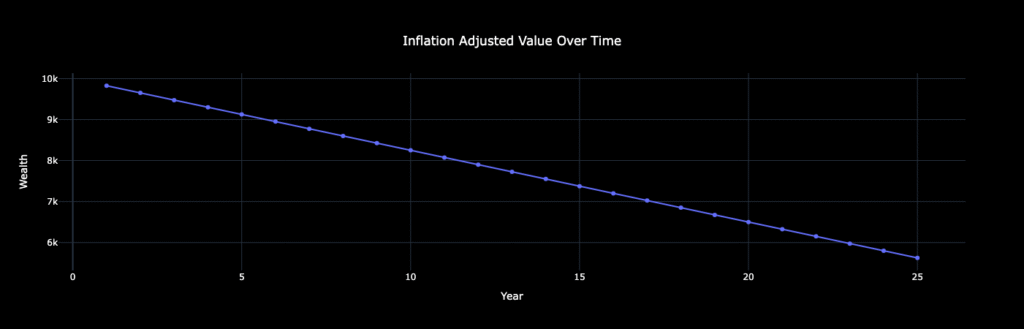

What if I showed you something like this:

And what if I told you that this is your $10,000 in your bank account that after 25 years becomes <$6,000?

This is actually a “safe” plot of what the actual purchasing power series would go, since I just took the values computed above, which we remember being a mean figure. It could be worse.

This is what inflation does, and this is also why:

Your Savings Account is Not Safe, It’s a Trap.

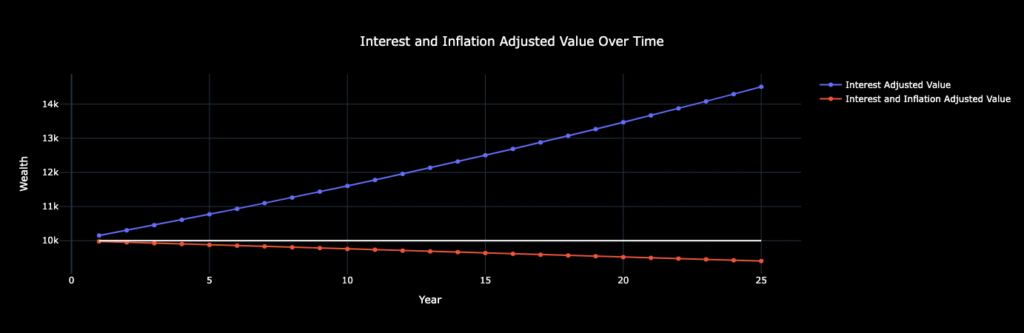

Let’s assume now, that for a particular reason – you live on Mars where savings account’s interest rates are >1%, let’s say 1.5% – you earn something by leaving your hard earned money in your account.

Oh no! It seems like your bank account is still losing value…

COMPOUND LOSS EXISTS.

As per the compounded gains, compounded losses are a sad but powerful reality. The fact that you still are reading, means that you’re ready to face the music and take action to avoid this ugly situation.

How the Wealthy Stay Ahead.

It’s not just the wealthy, really. I think that proceeding with hedging your exposure is plain smart.

How do you hedge though? Investing. Investing. Investing!

I will obviously delve into more detailed posts about this, but for now, I can only say that even $50 in a 10y Treasury Bond yielding (long-term average) 5.84% is better than a kick you-know-where.

Inflation-Proof Life: Fight Back.

Think in Real Terms, not Nominal.

By real and nominal terms, I mean returns. The real return helps you understand how much your purchasing power has increased after accounting for inflation. It can be applied to everything: your salary, expenses, gifts, anything.

Obviously, this can be a reliable benchmark for you to find out how much you actually gained.

Let me make myself clearer here:

- Nominal Return: raw percentage increase in money you earn/spend, without considering inflation (think of raises or plain investment gain)

- Real Return: nominal return adjusted for inflation, using basically the formula provided above.

To have a more “plug-and-play” formula, you can convert nominal returns into real returns by:

If you’re wondering “how does converting my expenses help me?” I can answer by saying that today you’re raising compelling questions.

Jokes aside, by converting nominal expenses into real expenses, you can factor out the increase given by inflation, effectively knowing how much (and if) some expense has increased.

Get Paid in Assets, Not Time.

Yes, obviously if you’re here I don’t think you are in the top 1% (if you are, hit me up Elon, I got some ideas), but you still could be paid in assets.

The main point I’m trying to make here is to always try to get involved in something that pays you passively. This way, you can compound your gains, your bank account.

By this point you already know that I will expand on this concept further down the road, but so far, we are booming if I thought you something new or just showed you some pretty things today.

Savings are for security. Assets are for wealth.

Leave a Reply